Knowing what you own is crucial for sound financial management. This comprehensive guide provides a step-by-step process to create a complete asset list, categorizing your possessions for clarity and future financial planning. We'll cover everything from readily available cash to long-term investments, ensuring you have a clear picture of your financial health.

Understanding Asset Categories: A Foundation for Your Listing

Before diving into your personal asset inventory, let's define the key categories:

Current Assets: These are assets easily converted to cash within a year. Examples include cash on hand, money owed to you (accounts receivable), and short-term investments. Think of these as your readily available resources.

Fixed Assets: These are long-term assets used in your business or personal life, typically depreciating over time. Examples include real estate (your house), vehicles, and major equipment. These represent significant, longer-term investments.

Financial Assets: This category encompasses your investments: stocks, bonds, mutual funds, and other securities. The value of these assets fluctuates based on market conditions.

Intangible Assets: These assets lack physical form but hold significant value. Examples include patents, copyrights, trademarks, and goodwill. Their value is often tied to their earning potential.

Personal Assets: This is a catch-all for personal possessions like jewelry, collectibles, and artwork. Valuing these items can be more subjective.

Building Your Asset List: A Practical Step-by-Step Approach

Creating your asset list is a straightforward process when broken down into manageable steps:

Step 1: Inventory Your Assets (The Comprehensive List): Begin by creating a comprehensive list of everything you own that holds value. Don't overlook seemingly minor items; accuracy is key. This initial inventory forms the base of your organized list.

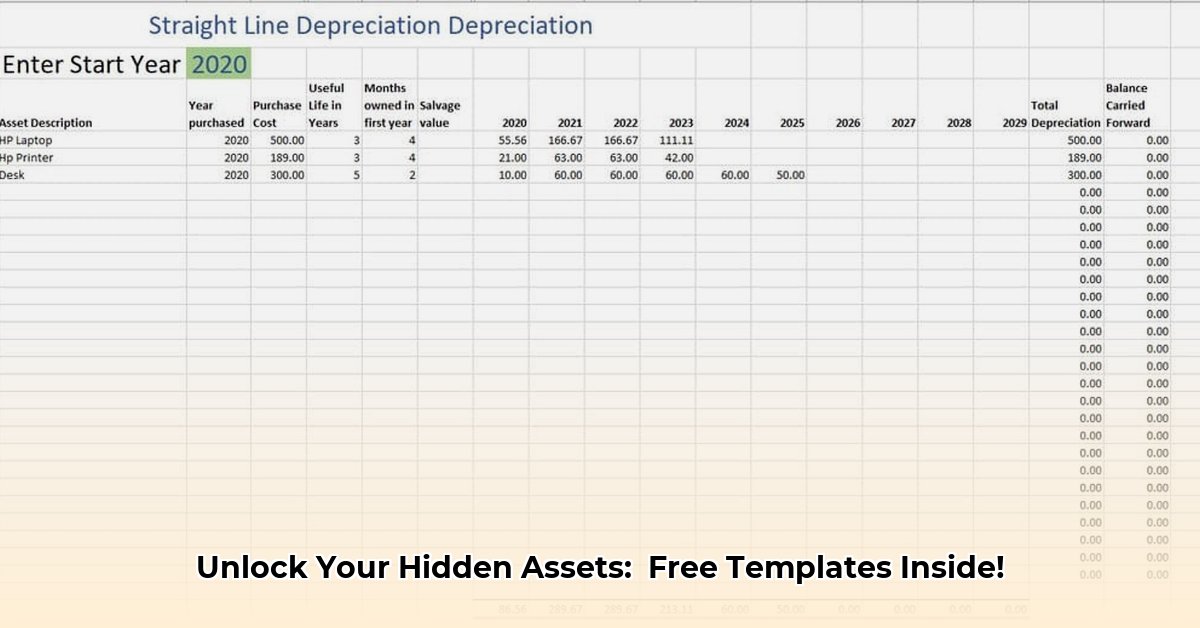

Step 2: Categorize Your Assets (Organizing for Clarity): Using the categories described above, assign each asset to its appropriate category. This step requires careful consideration; some assets might span multiple categories, depending on their role and use. For example, a rental property could be categorized as both Fixed Assets (due to its physical nature) and Financial Assets (due to its income-generating potential).

Step 3: Describe and Value Your Assets (Ensuring Accuracy): Provide a detailed description for each asset. For example, for a car include the make, model, year, mileage, and any recent repairs. Determining value can involve research and potentially professional appraisals (especially for real estate, art or collectibles). For liquid assets like stocks, utilizing current market prices will provide accurate valuation. Online resources are helpful, however always confirm with additional sources. It's preferable to slightly undervalue than overvalue your assets.

Step 4: Document and Secure Your Asset List (Protecting Your Information): Maintain your asset list digitally and in a secure physical location. Cloud storage is useful for digital backups. This comprehensive record-keeping is a powerful tool for financial management.

Step 5: Regularly Review and Update Your Asset List (Maintaining Accuracy): Your assets will naturally change. Regularly review and update your list at least annually or whenever you acquire or dispose of significant items. This ensures continued accuracy in your financial overview.

Asset Listing Examples: Illustrative Cases

The following table provides examples illustrating asset categorization and valuation:

| Asset Category | Asset Listing Example | Valuation Method |

|---|---|---|

| Current Assets | $10,000 in checking account, $2,000 in receivables | Bank statement, invoice |

| Fixed Assets | House valued at $400,000, Car valued at $20,000 | Recent appraisal, Kelley Blue Book |

| Financial Assets | 200 shares of XYZ stock, $15,000 in bond funds | Current market price, fund statement |

| Intangible Assets | Registered trademark, software license | Valuation based on projected earnings, market comparisons |

| Personal Assets | Antique furniture, collection of coins | Appraisal from a specialist, online auction data |

Beyond Inventory: Utilizing Your Asset List for Effective Financial Management

Your completed asset list becomes a vital tool for:

Financial Planning: Understanding your net worth facilitates informed financial planning, enabling better budgeting, investment strategies, and debt management.

Tax Preparation: An accurate asset list simplifies tax filing by providing a complete record of your assets and their value.

Insurance Needs: It helps determine adequate insurance coverage to protect your assets from potential loss or damage.

Estate Planning: This list forms a crucial element of estate planning, simplifying the distribution of your assets.

Creating a comprehensive asset list requires effort, but the benefits far outweigh the time investment. This guide provides the framework for clear organization, precise valuation, and ongoing maintenance of this important financial record. Regular updates ensure its continued utility as your financial landscape evolves.